Yesterday, CME continued to announce margin hikes for precious metal products. Following the previous margin increase last weekend, many speculate that CME is attempting to "manipulate" precious metal prices, particularly silver.

Historically, I have been very skeptical of claims that commodity exchanges manipulate prices. Fundamentally, they have no reason to do so. However, after yesterday's announcement, I am beginning to wonder: is this margin hike truly just for risk management?

Margin

The basic purpose of using margin in derivatives trading is to ensure that market participants can fulfill their payment obligations (in the event of a loss). Because of this, margins are typically adjusted when volatility increases/decreases, or when volatility rise/fall significantly over a short period (these are the two variables that increase/decrease investor losses, necessitating margin adjustments).

Although prices dropped sharply in the December 29th session, this volatility was triggered by the previous decision to raise margins, forcing investors to liquidate some of their positions. Furthermore, a deep price drop actually reduces potential losses for long positions. In other words, there was no clear justification for CME to raise margins again yesterday.

Setting aside the motive behind CME's decision, the new question is: Will this margin hike break the silver price's uptrend?

I maintain a bullish view on precious metals, both gold and silver. The primary support factor behind this silver rally is scarcity (or at least the concern regarding potential supply shortages). CME raising margins does not change this reality.

Perhaps CME (like Vietnam) believes the driver behind the current rally is speculation. Raising margins may eliminate some retail speculators, but institutional speculators remain, and the fundamental price drivers remain. Consequently, the uptrend may slow down, but it is unlikely to end as long as there is no satisfactory resolution to the supply side.

Silver Supply

The shortage of silver supply is partly reflected through fluctuations in silver lease rates, which we have mentioned and explained many times. However, it does not stop at financial figures—data types that many fear can be manipulated.

Over the past five years, global silver production has declined in most years. A large part of this decline comes from Mexico, a country that does not have the largest silver reserves but currently has the largest mining output (20% - 25% of global production).

Mexico's silver production is set to decline in 2025 due to the simultaneous impact of several factors.

First, output from old, long-established mines such as San Julián, Mercedes, Bolañitos, San Rafael, Dolores, and San Dimas is falling as they approach closure. Some new mines will begin operations, but they are not yet capable of offsetting the production loss from the old mines.

New law banning open-pit mining and new environmental assessment regulations in Mexico are slowing down the exploration and development of new mines, as well as reducing new output. For Mexico alone, the CAGR is projected to decrease by 2.9% annually to 200.6 million oz by 2030. Globally, the CAGR is projected at -0.9%, with production falling to 901 million oz by 2030.

Silver in Vietnam

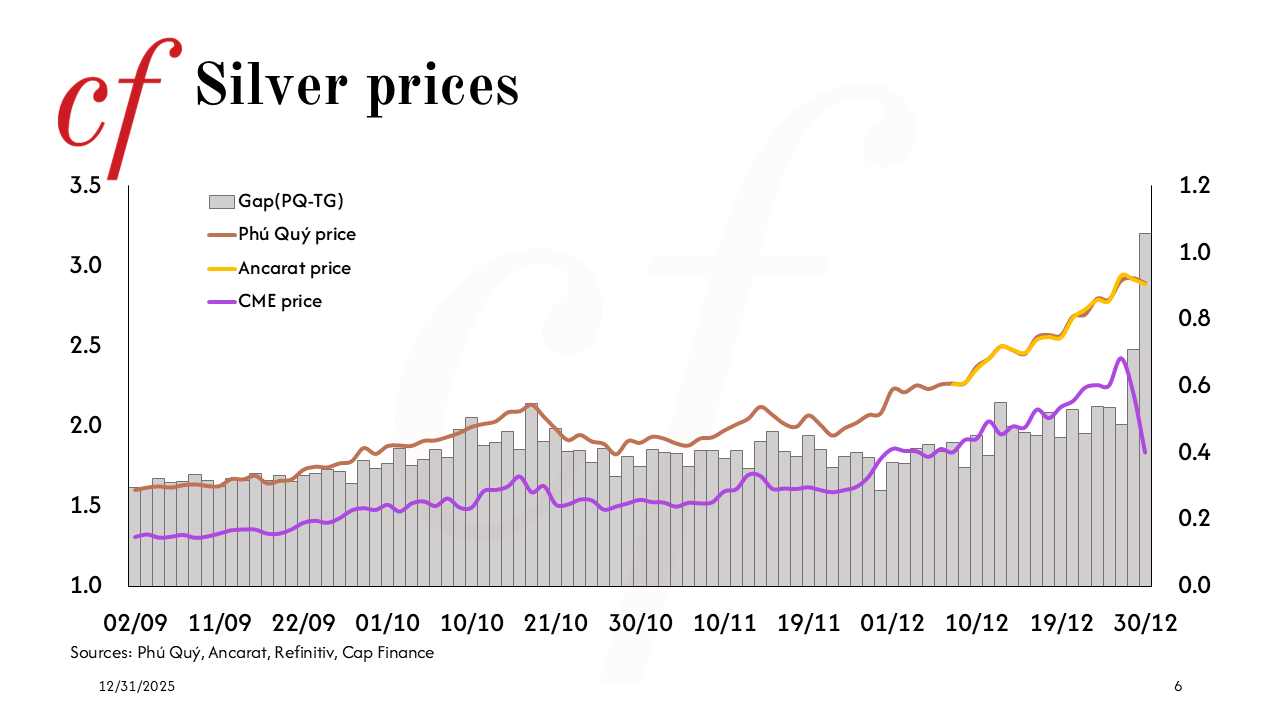

Although silver is a new candidate for asset accumulation in Vietnam, the silver price in Vietnam at this moment is not a good buying timing. Since Q3, the ratio between the spread (between the Phu Quy silver price (representing the Vietnamese silver price) and the world silver price) has consistently maintained a level of about 18% - 20% over the spot price, which is three times higher than the gold premium. This is a premium level that I personally do not feel comfortable buying at.

Notably, in the December 29th session, when world silver prices plummeted, Phu Quy silver prices only dropped slightly, causing the spread to skyrocket.

If you wish to hold silver, I believe we should wait for silver prices to stabilize after this recent parabolic run, especially after CME's continuous margin hikes. The best time might be after the Lunar New Year.